Back-Office Worker

Will AI replace back-office workers? At 80% risk, this is one of the most vulnerable white-collar roles. Data entry and claims processing are automating fast—here's what to do.

Traditional back-office work—data entry, document processing, claims handling—is being automated faster than almost any other white-collar function. The path forward is either specialization into exception handling or pivoting to customer-facing roles.

Will Robots Take My Back-Office Job?

If you work in data entry, document processing, claims handling, accounts payable/receivable, or any role primarily focused on processing transactions behind the scenes—you're probably already feeling the pressure. Here's what the data shows about where back-office work is headed.

The Honest Truth: Back-Office Was Built for Automation

Let's be direct: the core activities that define back-office work are precisely what computers do better than humans.

- Repetitive data processing → RPA bots handle this

- Document extraction → OCR + AI extracts information

- Validation against rules → Software validates instantly

- Routing and workflow → Automated systems route automatically

Back-office work emerged because companies needed humans to bridge gaps between systems, read documents, enter data, and check for errors. Technology is closing those gaps.

The pattern: Every wave of automation—spreadsheets, ERPs, RPA, and now AI—has reduced back-office headcount. AI is the steepest wave yet.

We've Been Here Before: The Typing Pool

In the 1960s, major corporations employed rooms full of typists to process correspondence and documents. The advent of word processors and personal computers eliminated those roles entirely.

Similarly:

- Bank tellers reduced 40% by ATMs

- Switchboard operators eliminated by automated switching

- Data entry pools reduced by direct system input

The pattern: When a job exists primarily to bridge human and machine capabilities, technology eventually eliminates the bridge.

What's different now: AI can handle not just structured data, but unstructured documents—invoices, emails, contracts, claims. That expands automation into areas that survived previous waves.

What AI Can Actually Do Today

Where AI Wins:

Document Processing:

- Extract data from invoices with 95%+ accuracy

- Read and categorize emails automatically

- Process insurance claims from start to finish

- Handle multi-language document translation

Transaction Processing:

- Accounts payable matching and processing

- Payment reconciliation

- Invoice validation

- Purchase order processing

Data Entry and Validation:

- Customer data entry from forms

- Database updating and maintenance

- Cross-system data synchronization

- Error detection and correction

Where Humans Still Win:

Exception Handling:

- Unusual cases that don't fit patterns

- Escalations requiring judgment

- Fraud investigation (beyond pattern detection)

- Customer disputes requiring empathy

Relationship Management:

- Vendor relationship issues

- Internal stakeholder coordination

- Problem-solving requiring context

Oversight and Quality:

- Final approval on sensitive transactions

- Audit trail verification

- Compliance sign-off on complex matters

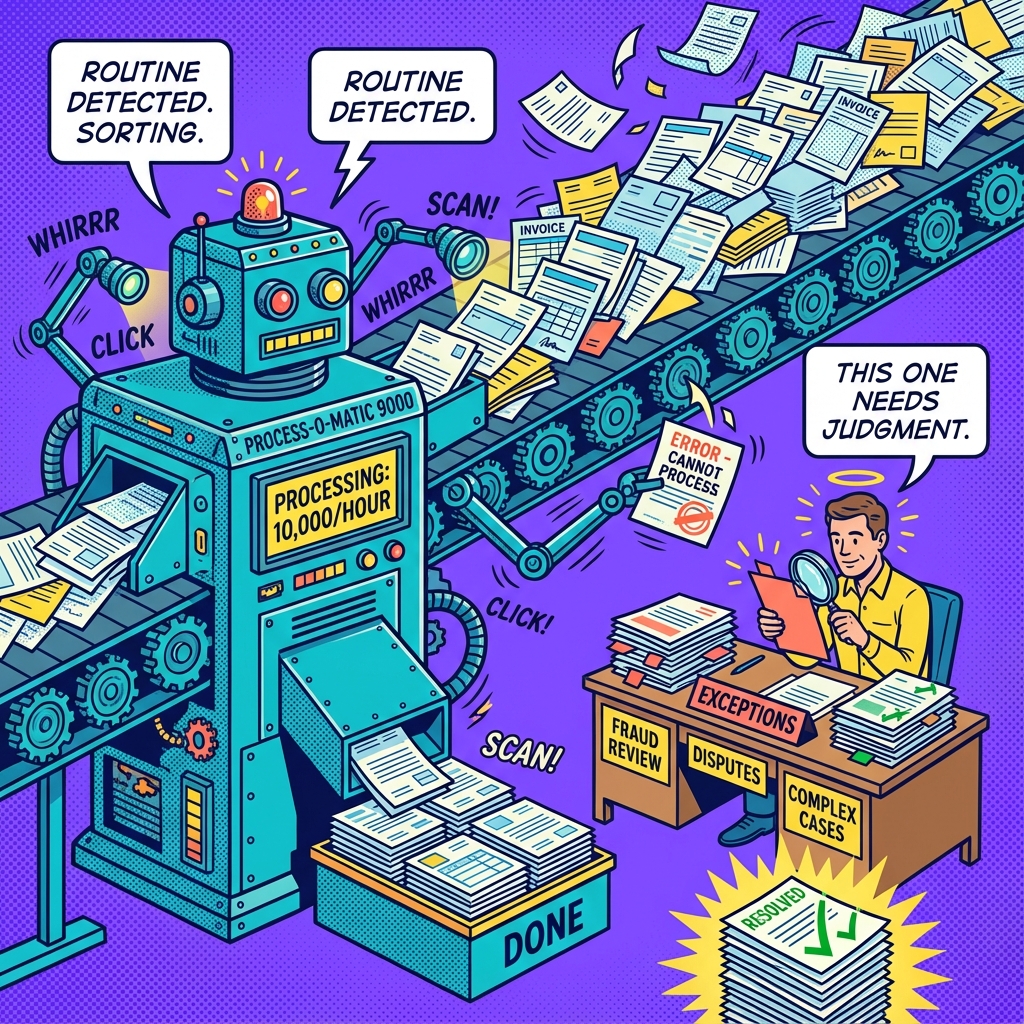

The Tasks Table: Robot vs Human

| Task | AI Capability | Human Advantage | Winner |

|---|---|---|---|

| Data entry (structured forms) | 95% | 5% - unusual formats | AI |

| Invoice processing | 90% | 10% - exceptions | AI |

| Email categorization | 85% | 15% - context | AI |

| Claims processing (routine) | 85% | 15% - judgment cases | AI |

| Payment reconciliation | 90% | 10% - disputes | AI |

| Document extraction | 85% | 15% - poor quality docs | AI |

| Exception handling | 30% | 70% - judgment | Human |

| Vendor disputes | 20% | 80% - relationship | Human |

| Fraud investigation | 40% | 60% - intuition | Human |

| Compliance sign-off | 15% | 85% - accountability | Human |

The pattern: AI handles volume; humans handle exceptions. As AI improves, exceptions become rarer.

Industry Breakdown: Where Cuts Are Happening

Banking & Financial Services

Bank executives have been explicit:

- JPMorgan told managers to "avoid hiring" as AI deploys across operations

- Goldman Sachs is conducting "front-to-back" organizational review

- IBM replaced 8,000 HR back-office roles with AI chatbots

Most affected: Payment processing, loan processing, account maintenance, reconciliation

Timeline: Already underway; accelerating through 2026

Insurance

Claims processing is the automation frontier:

- Routine claims increasingly processed end-to-end by AI

- Adjusters focusing on complex/high-value claims only

- Document intake and validation fully automated at major carriers

Most affected: Claims processors, data entry, policy administration

Timeline: 50%+ of routine claims automated by 2026

Healthcare Administration

Medical billing and coding are high automation targets:

- AI coding assistants improving accuracy and speed

- Prior authorization increasingly automated

- Patient data entry shifting to AI extraction

Most affected: Medical coders, billing specialists, prior auth staff

Timeline: Significant automation by 2025-2026, though regulatory complexity slows deployment

General Corporate

Accounts payable/receivable across all industries:

- Invoice processing bots standard at large companies

- Expense processing automated

- Vendor payment matching automated

Most affected: AP/AR clerks, expense processors, data entry

Timeline: Already widespread; continuing acceleration

The Salary Reality

Here's the uncomfortable math:

Back-office salaries (typically $35,000-$55,000):

- Low enough that companies tolerated inefficiency

- Not low enough to survive automation economics

Automation cost:

- RPA bot: $5,000-$50,000/year (handles work of multiple people)

- AI document processing: Often pennies per document

- Break-even typically achieved within 6-12 months

When automation costs less than one employee's salary and handles the work of multiple employees, the math is unfavorable for humans.

Who Should Actually Worry?

High Risk (Act Now):

- Data entry clerks - Core function is automation target

- Document processors - AI reads documents faster and cheaper

- Accounts payable/receivable clerks - Transaction processing automated

- Claims processors (routine) - End-to-end automation arriving

- Billing specialists (routine) - Standard billing automated

Moderate Risk (Adapt Required):

- Senior processors handling exceptions - Will remain but in smaller numbers

- Compliance specialists - Oversight needed, but volume of work decreases

- Quality assurance roles - Checking AI output rather than checking human output

Lower Risk (Relative Safety):

- Customer-facing roles - Where you interact with people, not just process transactions

- Specialized exception handlers - Fraud, disputes, complex cases

- Regulatory/compliance sign-off - Where human accountability is legally required

- Roles requiring significant judgment - Investigation, analysis, escalation management

The Pivot Paths

Path 1: Exception Handler Specialist

The play: Become the person who handles what AI can't.

- Fraud investigation

- Complex disputes

- Unusual cases

- Escalation management

Why it works: AI handles volume but creates exceptions. Someone needs to handle exceptions with judgment.

Skills to build: Investigation methodology, critical thinking, decision documentation

Path 2: Move to Customer-Facing

The play: Transition from back-office to roles where human interaction is the value.

- Customer service (yes, also under pressure, but humans still needed)

- Client relationship management

- Inside sales

- Customer success

Why it works: Human connection remains valuable. Companies are more willing to automate back-office than front-office.

Skills to build: Communication, problem-solving, relationship management

Path 3: Become the AI Supervisor

The play: Learn to manage, train, and quality-check AI systems.

- Monitor AI output for errors

- Handle exceptions and escalations

- Provide feedback for system improvement

- Ensure compliance with AI decisions

Why it works: AI systems need oversight. Your domain knowledge of back-office processes is valuable.

Skills to build: AI literacy, quality assurance, exception identification

Path 4: Specialize in a Domain

The play: Add domain expertise that makes you valuable beyond processing.

- Become expert in healthcare billing regulations (not just processing)

- Become expert in insurance fraud patterns (not just claims)

- Become expert in financial compliance (not just transactions)

Why it works: Deep expertise in complex domains is harder to automate than processing.

Skills to build: Domain knowledge, regulatory expertise, analytical thinking

The Bottom Line

Back-office work is being automated because it was designed for automation: repetitive, rules-based, and bridging gaps between systems.

The honest assessment: If your job is primarily data entry, document processing, or routine transaction handling, the automation timeline is 2-4 years. Some roles are already gone.

The opportunity: Exceptions, judgment, oversight, and customer relationships remain human. The back-office workers who survive will be the ones who specialize in what AI can't do.

Your move: Look at your daily tasks. If 80%+ is routine processing, start planning your pivot now. The best time to move is before the headcount reduction is announced.

What's Next?

Ready to future-proof your career? Our AI Adaptation Guide covers the skills and strategies that matter across every profession—from embracing AI tools to doubling down on uniquely human strengths.